Consulting services are tailored to meet our client's needs through retainer, hourly, and/or fee-based agreements. We are uniquely positioned to provide to our clients financial modeling services, funding source solicitation & review, project management & support, project summaries & reports, potential acquisition analysis, and a variety of specific project underwriting.

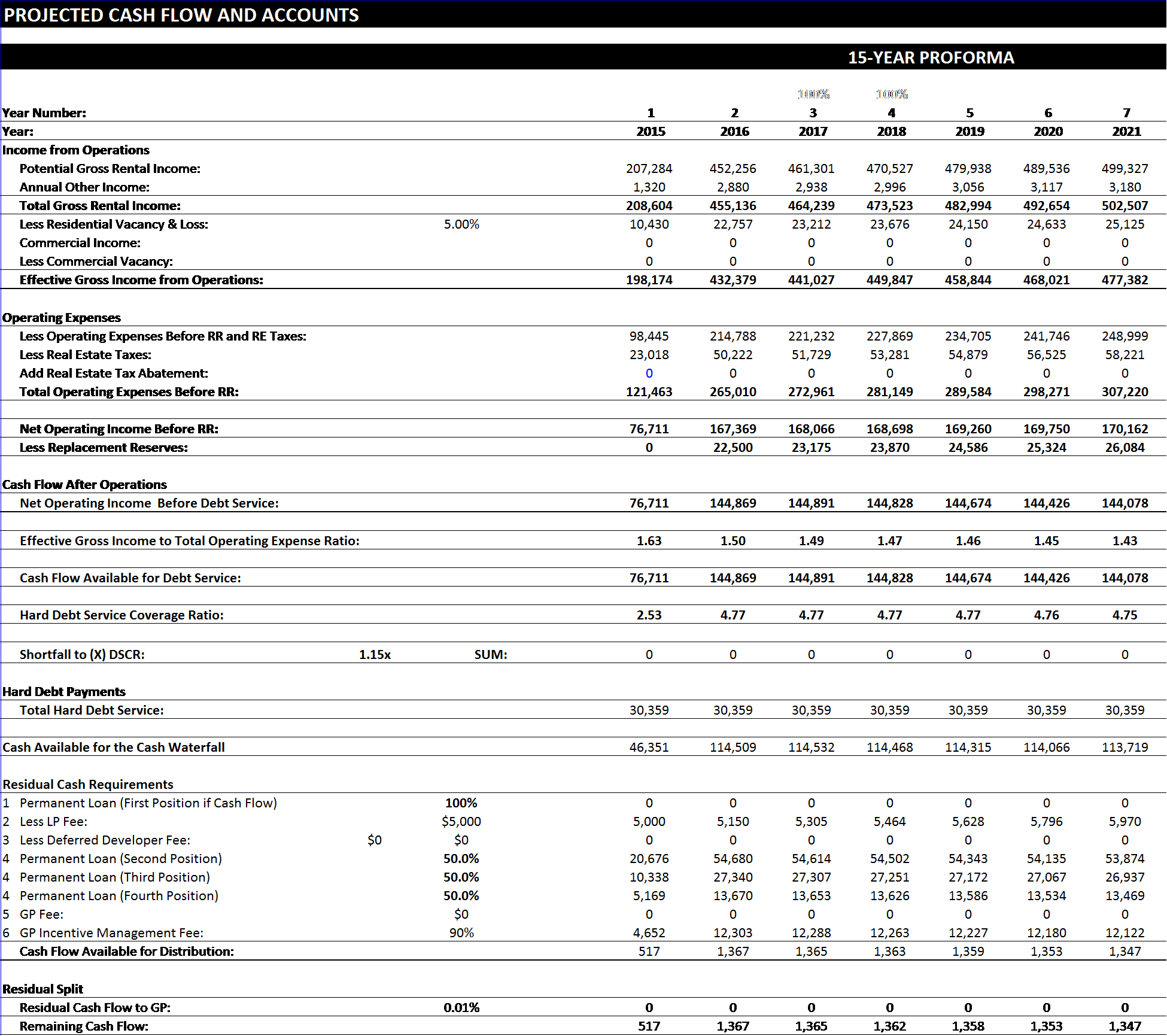

An informed upfront and evolving analysis of a project's programming including identification of feasible scenarios for capital structuring, on-going proforma evaluation, pre-development to closing due diligence management, and risk identification & mitigation planning provides our clients peace of mind for a successful closing process. Starting with our audited financial model, RCH Jones works with clients to determine the most successful scenarios for each project.

Project Modeling Including...

Both lower-tier & upper-tier projections

Tax credit basis, market pricing and credit delivery analysis

Unit mix and rent analysis

Extended period residual valuation

Development timeline analysis

Debt sizing analysis

Construction period source and use analysis

Operating expense analysis

Funding Source Solicitation and Review...

LIHTC application support, review, and management

Identification of potential equity investors

Identification of potential construction and permanent period debt lenders (both conventional and bond)

Identification of potential soft loan financing sources

Review of applicable state allocating agency qualified allocation plans (QAPs)

Deal term comparison and review of investor letters of intent (LOIs)

project support

Coordination, complete review, and analysis of project due diligence as requested by:

Tax credit allocating agencies

Construction period lenders

Permanent lenders

Soft source lenders

Other funding sources

Development team coordination & assistance

Closing process support & management

Construction period review support

On-going financial modeling

Project Summaries & Reports...

Project narrative production

Financial underwriting reports

Presentation material for specific audiences

Investor prospectuses

Assistance with presentations

Funding requests for proposals

Initial Project Feasibility Analysis...

Asset Repositioning

Acquisitions Analysis

New Development Scenario

Public Housing Conversion

Re-Syndications

Portfolio Review

Highest & Best Use Analysis

Valuations

Contact Us: By Phone (303) 305-8128 | By Email ryan@rchjoneshousing.com

Boulder, Colorado